Facts About Clark Finance Group Uncovered

Table of ContentsThe Greatest Guide To Clark Finance Group Home Loan CalculatorThe Facts About Clark Finance Group Home Loan Lender RevealedAn Unbiased View of Clark Finance Group Home Loan LenderNot known Factual Statements About Clark Finance Group Home Loan Calculator The Basic Principles Of Refinance Home Loan

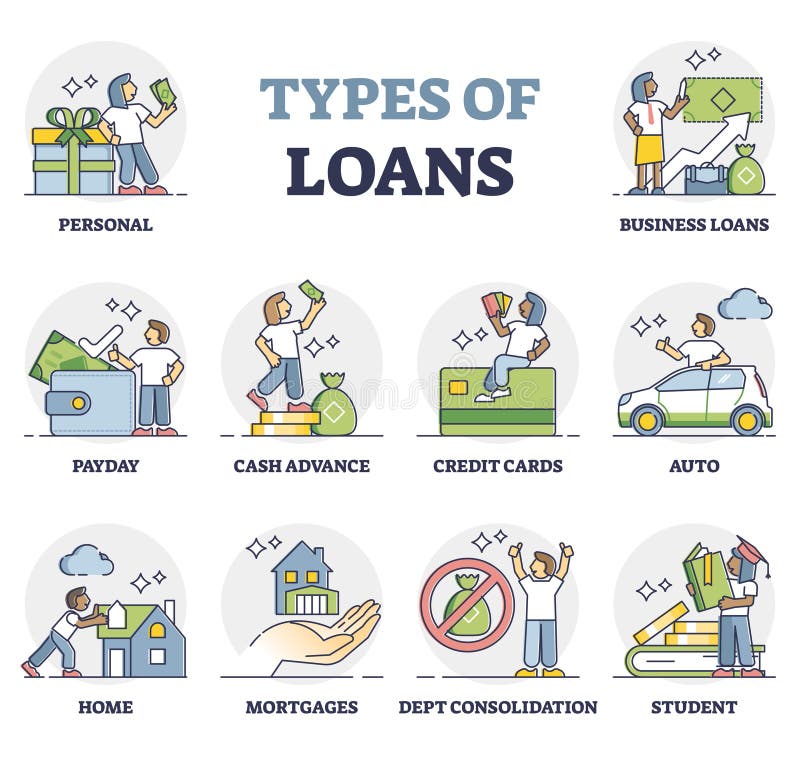

For that factor, a individual line of credit score or charge card can be an extra functional financing alternative, as you can borrow on a rolling basis. 15. Leisure automobile and boat lendings Whether you're seeking a mobile home or an electric motor boat, you might need help financing it. Personal finance lenders commonly allow you to obtain for this purpose.You might obtain as needed, nevertheless, up to your credit score limitation. It's constantly a great suggestion to zero your credit history card equilibrium each month so that you don't pay the double-digit interest prices associated with Visa, American Express and other financial institutions.

Credit score lines likewise only bill rate of interest on the cash you borrow, yet early repayment is your best choice. What kind of lending should you borrow? Whether you're seeking to finance a "need" or a "want," there are several kinds of lendings. As well as although it may be evident to you what kind of car loan to borrow, you could not be 100% sure regarding the certain lending terms.

Unknown Facts About Home Loan Lender

Unsafe vs. safe finances When it comes to the various kinds of finances, they all drop right into one of two categories: unprotected as well as protected. A guaranteed funding does call for security, such as your car or a financial savings account, as well as its value might influence how much you're qualified to borrow.

variable rates Whether your loan is unsecured or secured, there's the issue of passion, which is your key cost to obtain the cash. commonly the London Interbank Offered Rate (LIBOR) or the Prime Rate. (LIBOR will certainly be phased out by the end of 2021, according to the Customer Financial Security Bureau (CFPB), as well as can be replaced by the Secured Overnight Funding Rate or SOFR.) Many kinds of loans come with set rates of interest, yet the rate you get for either will certainly be based on your credit rating.

The 5-Minute Rule for Clark Finance Group Home Loan Calculator

Dealt with rates of interest enable you to understand just exactly how a lot the financing will cost you in its whole and also enable you to budget plan appropriately. Variable rates of interest car loans may conserve you money if rate of interest go down, but if they increase, they could wind up costing you much more. While they do have ceilings to protect customers from huge enter the market, those ceilings are typically set rather high.

Standard Fixed Rate Mortgages A mortgage in which the passion price continues to be the very same throughout the entire life of the finance is a conventional fixed price mortgage. These lendings are the most prominent ones, representing over 75% of all house financings. They generally are available in regards to 30, 15, or one decade, with the 30-year alternative being the most popular.

The greatest benefit of having a set go price is that the homeowner recognizes specifically when the interest as well as major payments will be for the size of the loan. This allows the property owner to budget plan much easier because they know that the rehab loan interest rate will certainly never ever change for the duration of the loan.

The 25-Second Trick For Clark Finance Group Mill Park

The price that is set initially is the rate that will certainly be billed for the entire life of the note. The homeowner can spending plan because the monthly settlements stay the same throughout the whole size of the loan. When prices are high as well as the property owner gets a fixed price home loan, the homeowner is later on able to refinance when the prices go down.

Some financial institutions wanting to maintain a great customer account may swing closing costs. If a purchaser gets when rates are reduced they maintain that rate secured also if the more comprehensive rates of interest setting increases. However, home customers pay a costs for securing certainty, as the passion rates of fixed price lendings are normally greater than on flexible rate mortgage.

Clark Finance Group for Dummies

Most down payments are around 10% or greater. The FHA program uses down repayments for as low as 3.

Borrowers can buy a house in any type of community located in the United States, the Area of Columbia, or Extra resources any kind of territory the United States holds. You can acquire a solitary household house, two device houses, three and also 4 system residences, condos, mobile houses, as well as made houses. Every home-buyer does not have a social protection number.